Marketing & Media trends

Industry trends

BizTrends Sponsors

Trending

#BizTrends2023: Pockets of opportunity in a tough residential property market

Lightstone puts its high road house price inflation scenario at 3.2%, a mid road scenario of 2.9% and a low road scenario of 2.7%, while we expect inflation to average at around 3% in 2023.

Gauteng, the Western Cape and KwaZulu-Natal remained South Africa’s powerhouse provinces with close to 66% of the volume of properties and 80% of the value of the market. There were 6.9 million residential properties registered at the Deeds Office, around a third of which were bonded – although their value touched 49%.

Despite the growth potential of the residential property market, political and economic uncertainty, immigration and semigration, load shedding and rising inflation were among the major challenges foreseen by estate agents surveyed by Lightstone in late 2022.

These factors were among the primary drivers of the trends which will shape the market in 2023. They are:

- Transfer volumes will continue drifting.

- Semigration to the Western Cape will continue.

- Homeowners in the mid to higher price bands will continue to choose estate and sectional title over freehold.

- Prices will perform better in the lower price bands.

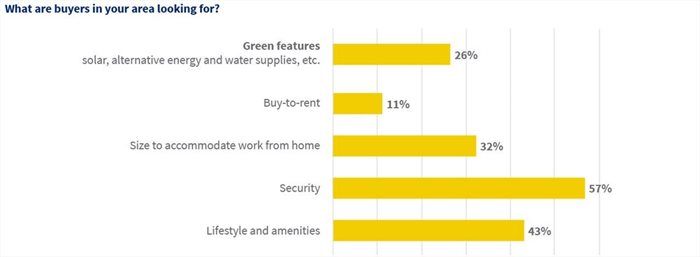

- Security, lifestyle, and work-from-home will drive buyer needs.

1. Transfer volumes drift as sales tread water

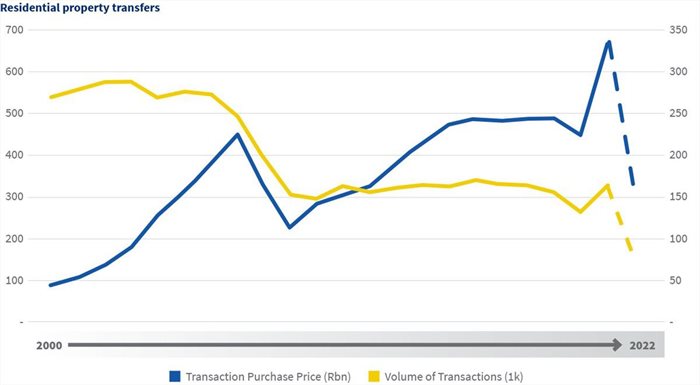

Transfer volumes are likely to remain between 300,000 and 350,000 in 2023, where they have drifted since the financial market crash in 2008/9.

The historically low interest rates in 2021 provided a glimpse of what could happen under the right conditions. We saw bigger gains in higher valued bonds and properties and the average value of property transacting that year increased to over R1m, with transaction volumes weighted towards the higher end of the market.

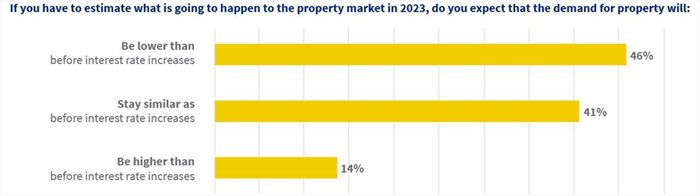

But ongoing electricity blackouts, political uncertainty and poor economic fundamentals, both locally and abroad, suggested 2023 would do well to hold steady – and estate agents surveyed by Lightstone in 2022 agree (see graph below), most believing the demand for property will either drop or remain where it was before the interest rates increased.

The 46% who believe demand will drop cite affordability, lower demand and a shift towards renting as consumer pressure increases as the main reasons. The 41% who believe it will stay the same believe that many people will still need to relocate, scale down due to affordability or be forced to sell, so there is optimism that the market will remain active.

Although only 43% of those surveyed reached their sales targets in terms of volume and 46% achieved their targets in terms of value in 2022, down from 51% who achieved their sales targets in 2020 and 69% in 2019, 80% expect to reach their sales targets in terms of volume and 78% expect to reach their targets in terms of value.

2. Semigration to the Western Cape will continue

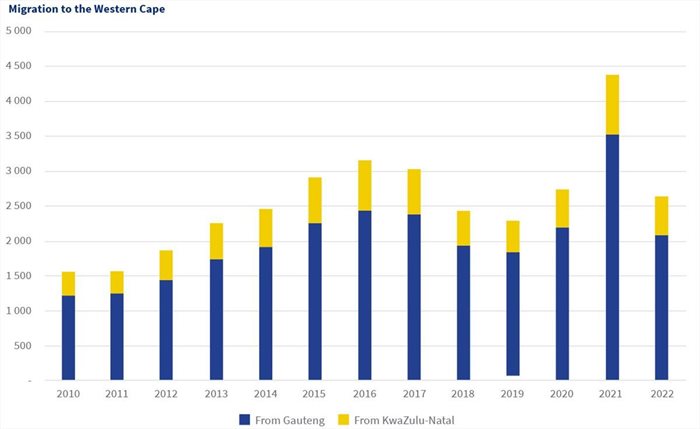

There has been an ongoing movement of people out of Gauteng, and Lightstone’s recent survey of estate agents confirms this will continue. Estate agents say the Western Cape is the most popular destination for those who can move, and the graph below confirms a steady movement of people to the Western Cape from Gauteng and KwaZulu-Natal – other than a dip in the years 2017 to 2019.

Covid-19 and “crime-and-grime” were among the key reasons behind semigration in recent years.

3. Homeowners in mid-higher price bands will continue to choose estate and sectional title over freehold

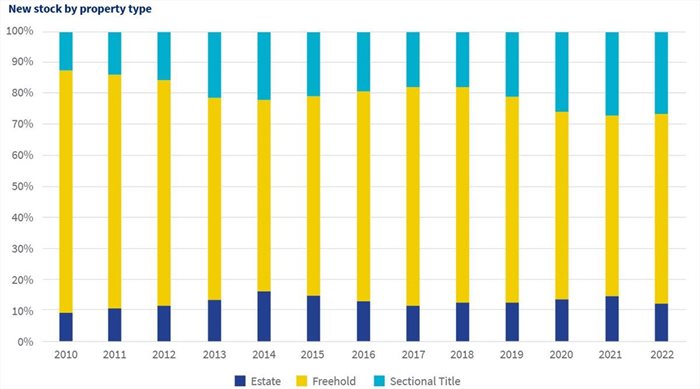

While freehold properties dominate the market, activity in recent years suggests a growing preference for sectional title and estate living and we expect this to continue in 2023. Our survey of estate agents confirms that gated communities and estates are in high demand.

The graph below demonstrates the relative decline of new freehold stock coming onto the market since 2010, when it accounted for just under 76% compared to 58% in 2021.

New sectional title stock now accounts for more than double the 12% it did in 2010 and estates are up from 9.3% in 2010 to 14.6% in 2021.

Interestingly, the graph below shows that freehold remains the property of choice for lower price bands, while confirming mid to upper price bands show a preference for estates and sectional title properties.

4. Prices will perform better in the lower price bands

The low value / affordable market was performing well, although its growth rate had dropped below 10%. However, the luxury market was a concern as it was tracking downwards, and it typically was a leading indicator for what to expect with house price growth in the high and mid value segments.

5. Security, lifestyle, and work-from-home drive buyer needs

Estate agents told Lightstone that security, followed by lifestyle and amenities and size to accommodate working from home are the top three features that buyers are looking for in a property. Interestingly, green features come in fourth place, in part reflecting a more sustainable approach to living, but also an indication of more and more homeowners seeking their own sources of energy and water.

While these trends are expected to feature prominently in 2023, the volatile and ever-changing political and economic realities could alter the picture, positively or negatively, relatively quickly.