The total Tier 1 capital, a key measure of banking strength, reached $10.38tn, an increase of 4.7% year on year. The minimum Tier 1 capital needed to enter the 2022 ranking also reached an all-time high of $556m. In addition, aggregate total assets have broken the $150tn barrier for the first time – at $154.21tn.

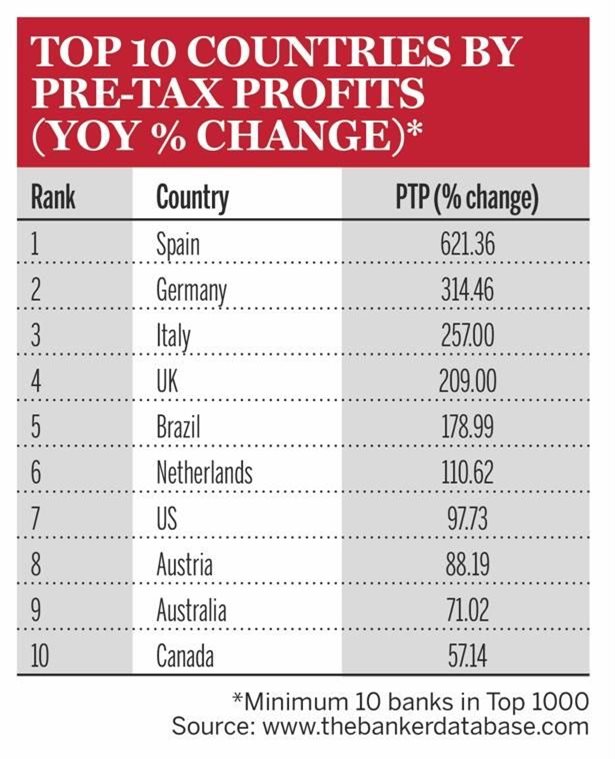

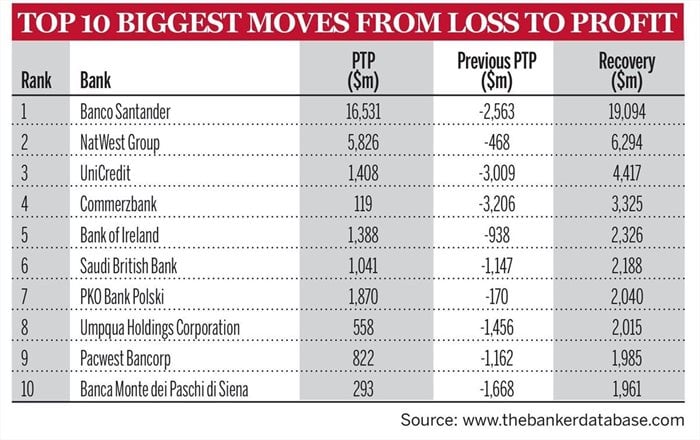

Profits saw a healthy rebound, with aggregate pre-tax figures reaching a record-breaking $1.44tn. This is a 53.7% year-on-year increase, compared to a decrease of 19.2% in the 2021 ranking. However, much of this boost can be attributed to a reduction or reversal in last year’s credit impairment charges for expected loan losses that didn’t materialise.

Said Joy Macknight, editor of The Banker: “Our analysis shows that 2021 was an outstanding year for the global banking industry, with record-breaking results in Tier 1 capital, assets and profitability. Importantly, non-performing loan levels decreased substantially, contrary to end-2020 expectations.”

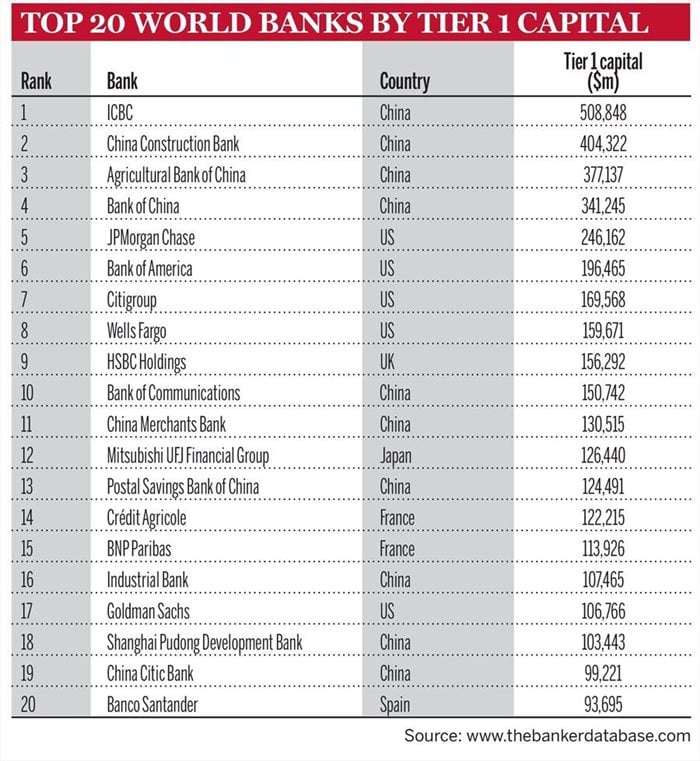

China continues to outpace its nearest rival, the US, in terms of both Tier 1 capital and asset growth, underpinned by a strong domestic economy which grew at 8.1% in 2021. China expanded its aggregate Tier 1 capital by 14.4% (versus 4.7% for the US) and total assets by 10.9% (versus 8.8% for the US).

With 140 banks in the ranking, four fewer than in 2021, China has more than double the Tier 1 capital ($3.38tn) and almost double the assets ($41.53tn) compared to the US, with 186 banks. Overall, China holds 32.5% of the world’s Tier 1 capital and 26.9% of its assets.

Industrial and Commercial Bank of China (ICBC), China Construction Bank, Agricultural Bank of China, and Bank of China held onto the top four spots in the ranking for the fifth year in a row. With Bank of Communications edging into 10th position, Chinese banks now make up half of the top 10 for the first time.

ICBC has now spent a decade at the top of the ranking and is the first bank to record Tier 1 capital of over $500bn ($508.85bn). It increased Tier 1 by 15.7%, total assets by 8.1%, and pre-tax profits by 11.1%. It now has more than double the Tier 1 capital of the largest US bank, JPMorgan ($246.16bn).

In fourth place overall, JPMorgan remains the largest US bank, with a 4.8% rise in Tier 1 capital, followed by Bank of America (BofA), Citi, and Wells Fargo. Citi and Wells Fargo saw slight increases in Tier 1 of 1.3% and 0.9%, while BofA experienced a slight drop of 1.8%.

HSBC remains the only European bank in the top 10 for the 11th year running and is now the only constituent that is not Chinese or American following Mitsubishi UFJ Financial Group’s drop from 10th to 12th position. Wells Fargo moved up to eighth and HSBC fell one position to ninth, resulting from a 2.4% contraction in its Tier 1 capital, to $156.29bn.

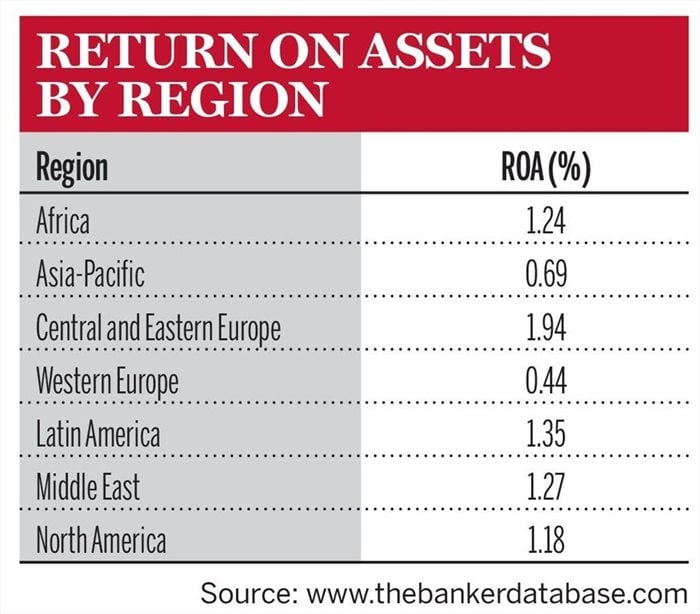

Western Europe was the only region to record a contraction in Tier 1 capital (3.6%). In addition to HSBC, the other three European banks in the top 20 – Crédit Agricole (14th), BNP Paribas (15th), and Banco Santander (20th), also suffered slight declines in Tier 1 capital, resulting in falls in ranking. In addition, the region posted a 2.5% contraction in assets and an almost 3% decrease in loans. Western Europe is the region with the lowest return on assets (0.44%) and return on capital (8.4%).

“The global banking industry is in a strong position to deal with the challenges emerging in 2022,” said Macknight.

“The year has had a tumultuous start, with the war in Ukraine amplifying supply chain challenges and commodity volatility as well as global inflationary pressures and the winding down of Covid-19 stimulus packages. However, the rising interest rate environment is expected to help banks’ margins and profitability.”