Marketing & Media trends

Industry trends

BizTrends Sponsors

Trending

#BizTrends2024: Unpacking the agriculture market's 2023 performance and forecasting 2024

The intermittent electricity supply in the country that disrupted irrigation schedules exacerbated the situation as farmers could not irrigate crops at the right time during the day.

A significant portion of horticulture crops, mainly fruit and vegetables, are grown under irrigation that is mostly powered by electricity. Further, electricity is crucial post-harvesting of horticulture crops to maintain the cold chain and preserve quality of produce until it reaches the point of consumption.

In the case of field crops, crops affected included sugarcane, soybeans, and maize where irrigation accounts for 34%, 20%, and 15% of their total area planted. While almost half of wheat is produced under irrigation, the season had already ended for the winter crop early in the year.

Nonetheless, the weather did turnaround with good rains in a La Nina year ensuring sufficient crop recovery which delivered an excellent harvest at the end of the summer crop season.

The 2022/23 summer crop harvest was an impressive 20.74 million tonnes which is 6.8% higher year-on-year with maize accounting for 82% of the total production. Maize, a major staple for South Africa, saw harvest increasing by 6% year-on-year to 17.06 million tonnes of both the commercial and non-commercial crop.

Varied input cost pressures across industries

Loadshedding was a consistent negative for agriculture in terms of input costs in 2023. From primary production to agroprocessing, the unreliable electricity supply disrupted operations thus forcing producers to use alternative sources of energy mainly generators for power.

In addition to horticulture and field crops, red meat, poultry, dairy, piggeries, and wool all require electricity for processing and maintenance of cold chains. The use of generators raised their energy bill significantly as they had to run them for extended periods and diesel was also not cheap.

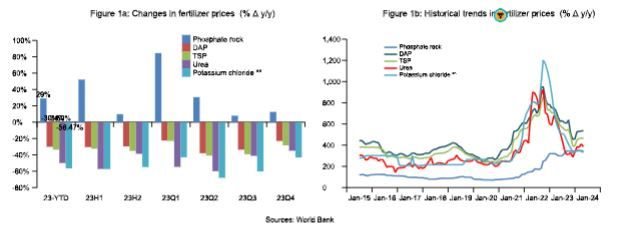

On the positive side, fertiliser prices reversed course in 2023 after a massive surge in 2022 due to global logistics challenges associated with the outbreak of the war in Ukraine.

Except for phosphate rock which increased by 29% year-on-year for the first nine months of 2023, the rest of the international fertilisers fell sharply with potassium chloride (KCL) posting the biggest decrease of 57% year-on-year, followed by urea, triple superphosphate (TSP), and di-ammonium phosphate (DAP) with declines of 50%, 33.6%, and 30.1% year-on-year, respectively (figures 1a and 1b). This means there was a reprieve for the summer crops farmers for the 2023/24 season in terms of fertiliser costs.

Further, fuel costs particularly diesel started to decrease towards year end with a decrease in November followed by another cut of 65 cents/ litre for all grades of petrol and R2.35/l and R2.41/l decreases for the two grades of diesel (0.05% and 0.005% sulphur), respectively in December 2023.

Figure 1: Trends in fertiliser prices in 2023

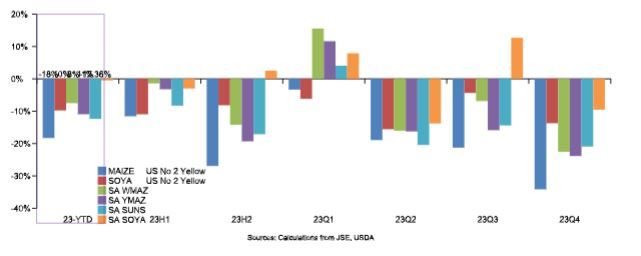

On livestock feed, prices of major raw feed inputs declined considerably from the record highs of 2022 thus relieving pressure on producers. The abundance of maize, a major ingredient which accounts for over 70% of total livestock feed, helped maintain downward pressure on prices.

Maize prices declined on average by 11% and 7.5% year-on-year for the yellow and white varieties, respectively in 2023 and more pronounced in the second half of the year which coincided with the completion of the harvest (figure 2). Prices of major sources of plant proteins used in animal feed also declined with sunflower down by 12% year-on-year while soybeans eased by 0.5% year-on-year.

Figure 2: Price trends of raw feed input prices – South Africa and International markets

A lapse in biosecurity continues to stunt South Africa’s agriculture growth.

Just like the rest of the world, South Africa is not immune to challenges on the biosecurity front. The major animal and crop diseases and pests that have a huge impact on the country’s trade are foot-and-mouth disease (FMD), Avian Influenza (AI), African Swine Fever (ASF), Citrus Black Spot (CBS), and False Codling Moth (FCM).

Livestock diseases such as FMD, AI, and ASF are reportable in terms of the World Organization for Animal Health (WOAH) and outbreaks are accompanied by import bans on animal products from affected countries.

SA had its fair share of severe outbreaks of FMD in 2022 followed by AI in 2023 that decimated the chicken flock. FMD stunted the export growth of products such as meat and wool from cloven-hooved animals, mostly destined for China and the Middle East. Fortunately, the situation improved in the second half of 2023 resulting in the resumption of exports to Saudi Arabia and China.

The CBS and FCM challenges are mainly with the European Union which has burdened SA’s citrus producers with onerous requirements that come at a huge cost and disadvantage to the industry. This debacle is yet to be resolved.

SA faces challenges in vaccine production due to the depletion of capacity at laboratories as well as efficient veterinary and related services. However, industry players and authorities have engaged in collaborative efforts that would include private sector laboratories to produce vaccines and this needs to be expedited in 2024.

Agriculture exports showed some resilience

Data from Trade Map showed that total SA agriculture exports topped US$10.2 billion for the first three quarters of 2023 which is slightly up by 1% year-on-year.

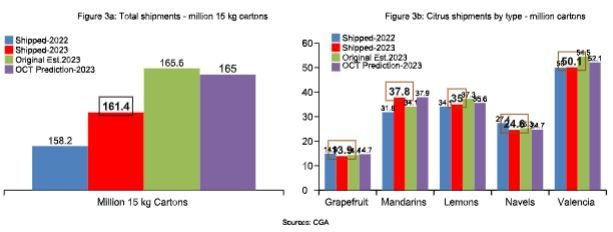

We saw good traction in some categories with our flagship agriculture export citrus’s volumes 2% year-on-year as of week 42 of the 2023 marketing season at 161.4 million 15 kg cartons although still shy of the industry prediction of 165 million cartons according to the Citrus Growers Association (CGA) reports (figures 3a 7 3b).

Maize continued to enjoy strong growth in exports with an impressive 8.5% y/y surge in volumes exported at 1.64 million tonnes in Q3 dominated by yellow maize (81%) followed by white maize (19%) according to the South African Grain Information Services (SAGIS) data.

Figure 3: Citrus exports by type - 2023

Loadshedding was a consistent negative for agriculture in terms of input costs in 2023. From primary production to agroprocessing, the unreliable electricity supply disrupted operations thus forcing producers to use alternative sources of energy mainly generators for power.

In addition to horticulture and field crops, red meat, poultry, dairy, piggeries, and wool all require electricity for processing and maintenance of cold chains. The use of generators raised their energy bill significantly as they had to run them for extended periods and diesel was also not cheap.

Enhanced logistics fuel industry growth

SA’s functioning public logistics infrastructure has deteriorated to such an extent that some face a complete failure if no urgent action is taken to address the situation.

Roads that are critical for moving produce from farms to domestic and international markets are in dire need of repair thus causing damages and delays at a huge to producers. Frequent port congestion delayed movement of goods thus impacting negatively on the economy.

Nonetheless, the crisis has elicited more innovation in the logistics sector such as investment in e-commerce with big data and analytics underpinning operations. Investment in new technologies to improve efficiencies and ensure resilient supply chains continues and benefits will be incremental in the longer term.

Government has approved the Freight Logistics Roadmap that seeks to reform the logistics system underpinned by Operations and rolling stock improvement; security and safety of the rail network; and a capital investment programme for the sustenance of operations and expansion plans.

Further, commitment to private sector collaboration includes the announcement of the Philippines-based multinational port operator, International Container Terminal Services Inc (ICTSI), an equity partner for a joint venture to take over the Durban container terminal.

Optimistic agriculture outlook despite challenges

We remain optimistic about the agriculture outlook for 2024 despite the El Nino weather pattern which is currently in full swing. However, its impact might be mild on SA given the good build-up of soil moisture and the replenishment of water tables and dams, as well as a relatively better start to the seasonal rains before the 2023/24 crop plantings.

Further good news is that El Nino will be a single-year event as it is forecast to taper off in the second quarter of 2024 with neutral conditions emerging strongly.

The robust global grain and oilseed production has curtailed price growth in international prices, and this coupled with a potential good crop limits further upside for domestic prices. This bodes well for overall food inflation into 2024 if there are no shocks to the system such as exchange rate risks and the intensification of adverse weather conditions during the critical phase of crop growth in the next few months.