Insight Survey’s latest South African Short-Term Insurance Industry Landscape Report 2023 carefully uncovers the global and South African short-term insurance landscape, based on the latest intelligence and research. It describes the latest global and local market trends, innovation and technology, drivers and challenges, as well as a detailed competitor analysis, to present an objective insight into the South African short-term insurance market environment and its future.

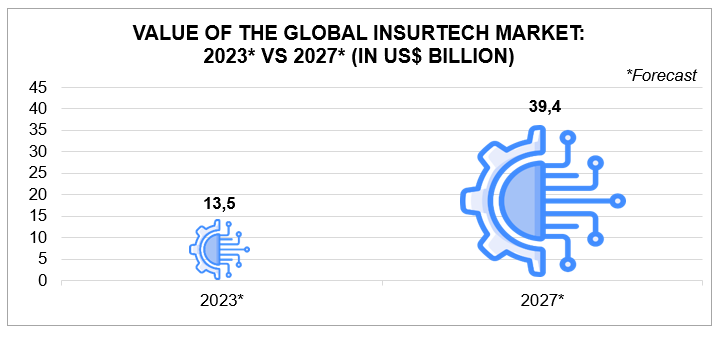

In terms of the Global Insurtech market specifically, significant growth is again expected, with the market projected to reach US$13.5 billion in 2023* and forecast to grow at a massive compound annual growth rate (CAGR) of 30.7% to reach $39.4bn in 2027*, as illustrated in the graph below. Growth of the global InsurTech market is being driven by the incorporation of artificial intelligence (AI), machine learning (ML), and cloud computing to enable better consumer demand predictions, planning, and decision-making.

According to the InsurTechDigital website, the African InsurTech market continues to thrive, with startups on the continent continuing to attract a large amount of funding, with $744.1m in funding being raised to date. This includes several major South African InsurTech companies, such as Naked, Pineapple, Nomanini, and Inclusivity Solutions, which have raised $22.4m in funding to date.

In terms of embedded insurance globally, a growing number of these products are being offered by major insurance players, via partnerships with InsurTechs. For example, in Canada, Duuo by co-operators launched a new embedded insurance application programming interface (API) that allows businesses to integrate insurance purchases into websites, apps, and platforms. The first product available is Duuo event insurance, which allows consumers to purchase event cover, whilst booking a venue.

Additionally, Allianz Partners recently partnered with bolttech, an international InsurTech, to provide embedded device and application protection insurance for business partners, such as retailers and e-tailers for electronic products and household devices, telecommunication providers, and banks, amongst a variety of other sectors. Another example includes Airbnb offering host protection and host guarantee insurance.

In South Africa, embedded insurance is becoming a major trend, and an opportunity to bridge the current insurance gap in the country, by providing insurance at the point of sale, and allowing consumers to get immediate coverage for goods and services. As an example, in September 2023, Aura partnered with the integrated consumer and business services company, Hello Group, to embed its business insurance and emergency response services into Hello Group’s merchant terminal service, Hello Pay. This offering was indicated to be extremely beneficial for the estimated 200,000 spaza shops and small businesses across South Africa that utilise Hello Pay’s services, by shielding them from economic harm.

This is also making its way into the car insurance space, with Tiger Wheel & Tyre introducing a new tyre and wheel insurance offering, namely X-Sure, in partnership with Hollard Insurance Company Limited and Motorite Administrators. This offering also incorporates a user-friendly mobile app, allowing consumers to seamlessly manage their policies and benefits.

Furthermore, vehicle manufacturer Chery, partnered with Absa and the insurance technology platform provider, the Innovation Group, to launch an extended motor warranty plan that assists vehicle owners in managing the costs of owning a vehicle by automatically activating as soon as the factory warranty has expired. This partnership aims to ensure that customers remain adequately covered for breakdowns or problems.

The South African Short-Term Insurance Industry Landscape Report 2023 (164 pages) provides a dynamic synthesis of industry research, examining the South African and global short-term insurance industry from a uniquely holistic perspective, with detailed insights into the current market dynamics and stakeholder positioning – market environment and size, industry trends, industry innovation and technology, industry drivers and challenges; as well as key competitor and product analysis.

Please note that the 164-page report is available for purchase for R50,000.00 (excl. VAT). Alternatively, individual sections for the report are also available, including our Global/South African Industry Section for R20,000.00 (excl. VAT), or our detailed South African Competitor Analysis Section for R32,500.00 (excl. VAT).

For additional information, please email az.oc.yevrusthgisni@ofni, call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

For more information or a brochure: SA Short-Term Insurance Industry Landscape Report 2023

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products, or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment, through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za